StashAway Review (Updated for 2020)

Passive investing in Malaysia

I started investing with StashAway at the end of 2018 and first published this review in early 2019. StashAway has changed a lot since then, and I've learned more about it to share some extra thoughts.

- What is passive investng? And why?

- How I found out about StashAway

- What is StashAway?

- Problems StashAway solves for me

- Other problems StashAway helps solving

- How to get started with StashAway

- What's inside StashAway

- Why I recommend StashAway to Malaysians

- Questions and concerns

- Final review of StashAway Malaysia

What is passive investing? And why?

I first learned about the idea of investing from the book Rich Dad Poor Dad when I was 17. The concept is as simple as putting your money away to make more money for you in return. However, the executions are often complicated, especially when everyone is trying to sell you some kind of financial products.

I’ve tried many investment vehicles in the past and lost some money along the way. After many trials and errors, I stumbled across the idea of passive investing. Instead of timing the market and buying into an individual company, passive investing is about buying the index of a market.

In other words, your investment grows as long as the economy grows. Even when the market goes down from time to time, it’s proven that in a long-run (20 years and above), the market grows about 7% annually.

It was first popularized by the founder of Vanguard, John Bogle. In case you want to learn more, you can check out:

- The Boglehead’s Guide to Investing

- I Will Teach You To Be Rich by Ramit Sethi

- Unshakeable by Tony Robbins

There are more books on similar topics like The Coffeehouse Investor and The Simple Path to Wealth.

How I found out about StashAway

The only problem is that I’m living in Malaysia where the index funds and ETFs market is not as established as the United States. At the same time, investing in US ETFs means high fees (up to $25 and more per trade) here in Malaysia.

Around the same time, I learned that there was a rise of robo-advisors in the United States like Wealthfront and Betterment. They are commonly recommended by many writers whom I’m following. This got me searching around for the same thing in Malaysia, and that’s how I found out about StashAway early 2018.

When I first stumbled across StashAway, they weren’t open to Malaysians yet, but encouraged us to join their waitlist.

I didn’t keep much hope for them to open anytime soon, so I went ahead to structure my investment portfolio based on the only ETFs available in Malaysia. The more I drafted out my investment plan, the more limitations I found as a Malaysian to invest in the market using the passive investing methodology.

By the mid of November 2018, I received an email from StashAway that announced their opening. I don’t usually make financial decisions immediately, but trust me, I immediately invested the first one-time capital and scheduled a monthly auto-transfer to StashAway—five hours after reading the email.

What is StashAway?

StashAway is a Singapore-based wealth management platform. Instead of an ordinary investment firm, they are more of a Fintech startup that focuses on solving common investment-related pain points. To top it up, they are the first robo-advisor that got approved by the Security Commission in Malaysia.

Their investing philosophy is to “put data, not emotions behind your money.” According to their website, they’re using a proprietary investment strategy called Economic Regime-based Asset Allocation™ that harnesses economic trends to maximize returns at the risk level that feels right to their users.

Instead of reacting to short-sighted, sporadic market activity, StashAway focuses on solid economic fundamentals.

Problems StashAway solves for me

In short, the ideology is similar to passive investing with an added layer of AI to structure your portfolios based on your investing goals and risk tolerance. That’s also why I hopped on to StashAway immediately last year because it helps me solve a few of my biggest pain points:

1. Lower annual fees

StashAway has a significantly lower annual management fee from 0.2% to 0.8% based on your total portfolio amount. Before using StashAway, buying overseas (in my case, the US market) ETFs costs me somewhere from $25 to $30 (MYR100 to MYR130) per trade, which basically means I’m paying a 10% fee when I invest MYR1,000.

That’s for one single trade. If I want to buy three different ETFs in a month to balance my portfolio, I can either invest MYR1,000 or more to keep the fees below 10% or I need to pay for almost 30% fee per trade. (MYR100 per trade for MYR330 per ETF). This got me to the next point.

2. Automatically buy, sell, and rebalance my portfolio

Trust me, buying ETFs, especially via the traditional brokers in Malaysia is a tedious process. And wait until you need to sell and rebalance your portfolio—that may be 10 times more complicated than just buying alone.

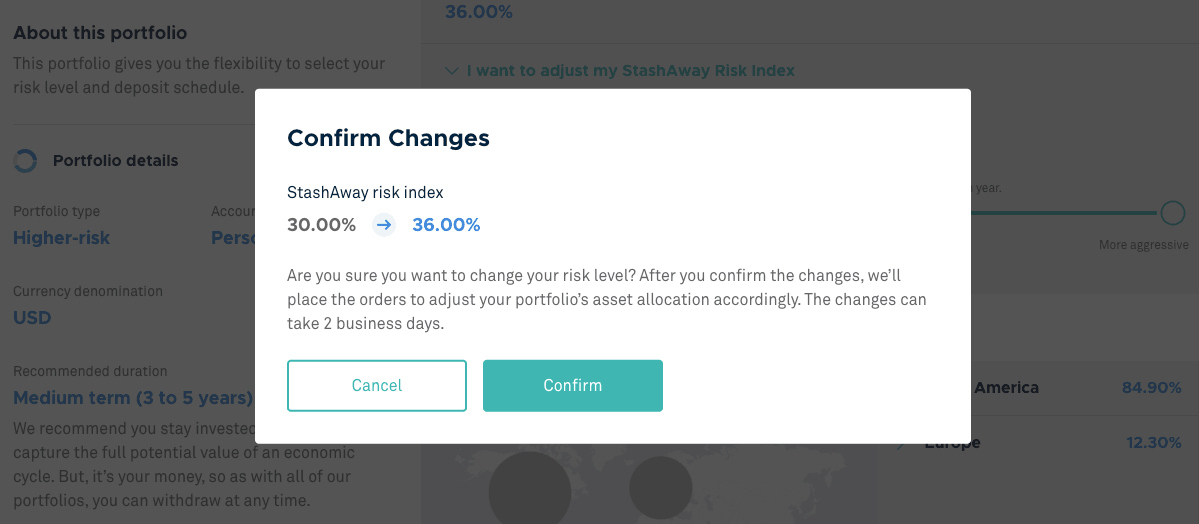

StashAway made this process simple and effortless for me. When I invest MYR1,000 every single month, it helps me to buy every ETF according to their proportion in my investment portfolio. In case I want to change my portfolio (you do this by adjusting your risk preference in StashAway), StashAway will rebalance all my holdings automatically.

It basically makes the passive investing much more passive and reduces any potential mistakes and errors caused by me myself.

3. Let me do what I do best

I’m not sure about your uncle John and your friend Sam, but I’m certainly far from a sophisticated investor—at least for now. I’m a writer and a marketer and I always prefer to do what I do best.

I read a lot about investing and been learning a lot about passive investing portfolios. But here is something I don’t know how to do: To identify undervalued index funds and avoid overvalued ones. If it wasn’t StashAway, I would probably hold what most everyone said on the Internet.

To me, StashAway provides the right amount of transparency and control—way more than most traditional brokers—that allows me to know what I need to know and ignore what I don’t need to know.

This way, I feel safe without being overwhelmed to invest automatically and put my main focus on my day job and personal blog.

Others problems StashAway helps solving

I just covered the biggest pain points StashAway has solved for me. They might not be what you care about most. Other than what I mentioned above, here are some other benefits of investing via StashAway.

4. Goal setting and calculation

When creating a new portfolio in StashAway, you get to choose to either invest for a life goal or general investing.

There are goals from planning for retirement to saving for your child’s education, from buying your first home to starting a business, and more.

For those who haven’t thought about their financial goals, StashAway is an excellent place to start.

5. Build saving and investing habits

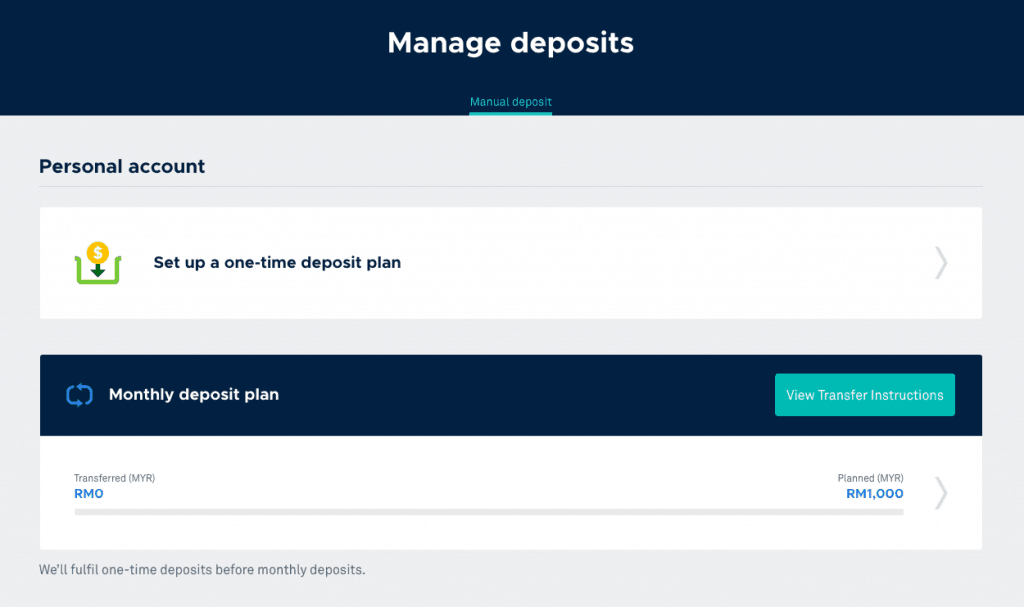

After you invest with the first one-time capital, you have an option to schedule a recurring deposit to automatically invest every single month via direct debit. If you find it hard to save and invest regularly, the best strategy is to automate it, so the money is invested way before you see it.

6. Investment alternatives

For experienced investors, especially in other investment vehicles like traditional mutual funds and real estate, StashAway could be an alternative to diversify your overall portfolio.

How to get started with StashAway

Signing up to StashAway is easy and straightforward. Click here and then follow the simple step-by-step instructions on StashAway.

What’s inside StashAway

If you’re like me, you’re likely still on the fence about signing up for StashAway. Indeed, I spent months researching multiple alternatives and options before StashAway is officially available in Malaysia.

To equip you with a better picture, I’m going to show you what’s inside StashAway using my personal account as an example.

There are three tabs on the StashAway main dashboard:

- Portfolios. Where you can see your portfolio(s) based on the goals.

- Performance. The overall performance of all of your portfolios.

- Transactions. Your deposit, investment, and withdrawal history by date.

You're being asked to set up a one-time deposit when creating your investment portfolio. After that, you're free to create a monthly deposit plan via JomPay or Interbank GIRO to invest automatically every single month.

The support page is easily accessible in the StashAway account. Personally, I see this as what separates StashAway from most traditional brokers.

This is where to withdraw the available fund in your StashAway account. I've not withdrawn anything from StashAway before this so I'm not entirely sure if it works as smoothly as it should be.

Every month, I receive an email update about the monthly statement from StashAway. The statement consists of the up-to-date portfolio details and every single transaction StashAway has made in the past month:

- My monthly deposit

- Conversion of my deposit from MYR to USD

- Purchase made for every index based on the portfolio allocation

- Rebalancing made if any

- Dividend received if any

This is an inside look of my personal StashAway portfolio. I named it Infinite Long-Term Investing because my plan is to keep stashing away a portion of my income infinitely.

Why I recommend StashAway to Malaysians

I’ve covered a lot thus far from what is StashAway, the problems it solves, and what’s inside. Now, I want to touch on why I highly recommend StashAway to Malaysians who want to start investing.

1. The passive investing philosophy

I started this article by showing my journey of learning about investing. I also lightly mentioned it in my personal finance guide. The truth is, the passive investing philosophy is not as common and popular in Malaysia, and I can understand why.

First, the so-called financial experts from the insurance agent to the mutual fund salesperson have nothing to gain from it. Secondly, there are just not that many options for ETFs in Malaysia. And finally, it’s not sexy to talk about—invest 15% of your income to index funds for 30 years versus owning five real estate properties with no money down—of course everyone would rather listen to the later.

That’s why I’m glad that StashAway is here. It might not be for everyone but it serves well as an alternative for people like us who prefer to get rich slowly—and surely.

2. Better transparency, control, and support

I hate to say it but it is truly P.I.T.A to deal with traditional brokers in Malaysia unless you have millions to invest. Most financial instruments are simply not designed for the average folks like you and me.

It literally took me weeks to open my first brokerage account via an investment bank, and it took me months just to figure out how to perform a trade. Worst, I learned it by reading blog posts, going through forums, and experimenting using the actual account. There are no clear instructions and easy-to-find knowledge base for it.

On the flipside, StashAway provides a fresh alternative to the market. I get to dive into the details to do my own due diligence way before I decided to sign up. Within the account, I get to see my exact portfolio and every transaction made by StashAway. They also send me a monthly statement via email that shows all the transactions in my account.

Other than that, the knowledge base is there to answer my questions whenever they appear and there is a clear way to contact the support whenever I need help.

3. Low fees and high conveniency

Last but not least, I recommend StashAway because of their low annual fees. Based on the book Unshakeable by Tony Robbins, high fees are the one thing that eats your money away.

However, most investors never realized it because it seems trivial to pay slightly more in fees. But when you run the calculation, a 1% addition of fees can eat away up to 20% of your portfolio value in a 30-year period.

That’s also why I don’t invest in mutual funds because most mutual funds charge up to a 5% sales fee with an additional 1% to 3% management fee and transaction fee combined. It means that you’re losing money before even making anything in return.

(And insurance is well, insurance—not an investment)

Putting mutual funds and insurance aside, I’m good with the fees charged by the traditional brokers when buying Malaysians stocks and ETFs. But when it comes to buying international stocks and ETFs, the fees are ridiculously high.

As mentioned above, I was charged $25 to $30 (MYR100 to MYR130) per trade for buying a US-based ETF. And to figure out the exact fees, I basically just made my first trade without knowing it and see how much they charge.

The only catch is that you lose the flexibility of owning a specific stock or ETF when you invest using StashAway. But as mentioned above, I see the inflexibility as a benefit to help me take care of my investment professionally and filter out things I don’t need to know.

Questions and concerns

It’s obvious that I love using StashAway. If not, I wouldn’t have written this long article to explain it in detail. But I do have a few more concerns about this new investing platform.

So I reached out to the support with questions below, and here are the responses I got from StashAway.

1. Is StashAway still a startup?

I wouldn't say we are still a Startup but we do keep that mindset i.e to innovate and improve at great speeds. Our current business goals are not to maximize profits or revenues and yes, we will likely still be looking to raise funds.

I was concerned if StashAway still operates upon venture funding OR the profit they made from their customers—like me. It seems like they are still raising funds as I write this.

It's not a good sign because it could mean StashAway hasn't made a profit yet (I'm not 100% sure but it's highly probable).

2. How can I nominate a beneficiary for my StashAway asset/value in the case of death?

You are currently unable to nominate a beneficiary. In the event of death of the account holder, your executor or administrator is the only person recognized by us. Your executor/ administrator will have to produce a grant of probate or letters of administration before the account can be liquidated to a designated account as instructed by him/her.

3. How do taxes work with withdrawal?

It depends on your country of tax residence. I believe in Malaysia, as with Singapore, there is no capital gains tax. However, as I am not a tax advisor, I do recommend that you consult a tax, legal and accounting advisors on any tax-related concerns.

Final review of StashAway Malaysia

As a conclusion, I think StashAway is the perfect fit for me and many beginner investors. Part of the reason is that many investment instruments available in Malaysia don’t fit me well after my thorough research.

Another part is that StashAway has no direct competitor yet in Malaysia. But in general, I would say they’re doing a great job even when they could easily grab a huge portion of the market share by being the pioneer.

It definitely sets a high bar for newcomers in the coming years but it’s always beneficial for us the users when FinTech startups—or any startups—are trying to win over us.

If you’re interested in investing via StashAway, click here to sign up now—only for Malaysians.

Footnotes

- I’m not a trained and certified financial planner, which means that you should not take my words above seriously without your own due diligence. To make it clear, what I laid out above is not what you must be doing but instead, they are simply what I’ve done. (Know what, just don’t listen to me.)

- If you’re interested in learning more about the passive investing ideology and general personal financial management, Bogleheads.org is my most recommended source.

- To find out how fees affect your portfolio over the long-run, here is a managed fund fee calculator you can play with.